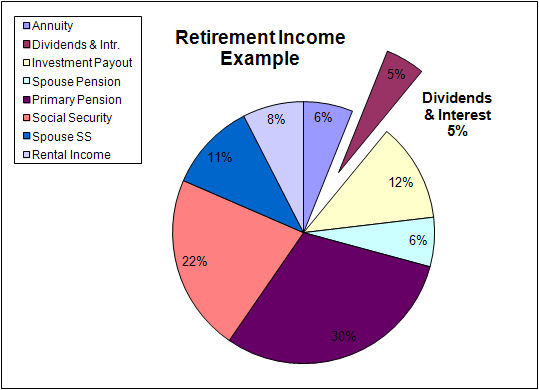

Supplement your retirement "paycheck" with regular Dividend & Interest income.

Interest Income

Nearly everyone receives interest on some of their investments, and interest payments have historically been a source of retiree income. Interest is paid on Certificates of Deposits (CDs), bonds, savings accounts, and several other investments. However, with today’s interest rates rarely exceeding 3.5%, there’s very little opportunity to earn a decent return, even with corporate CDs or municipal bonds.

The other disadvantage of interest-producing assets is that most interest is taxed as ordinary income. This includes most interest that you either receive or is credited to your account and that can be withdrawn without penalty. Examples include interest on bank accounts, money market accounts, certificates of deposit, and deposited insurance dividends.

Specific IRS rules apply to bonds, Treasury bills and notes:

- Interest on Series EE and Series I US Savings Bonds generally does not have to be reported until the bonds mature or are redeemed.

- Interest from Series EE and Series I bonds issued after 1989 may be excluded from income if used to pay for qualified higher educational expenses during the year and other requirements are met for the Educational Savings Bond Program.

- Interest income from Treasury bills, notes and bonds is subject to federal income tax, but is exempt from all state and local income taxes.

- Interest on some bonds used to finance government and issued by a state, the District of Columbia, or a U.S. possession is not taxable at the federal level.

- Municipal bonds and municipal bond funds are exempt from federal and sometimes state taxes (especially if you live in the state of issue).

Because Municipal bonds are tax-exempt, they may be important for higher-income individuals. Also, the tax-exempt and tax-deferred features of Government bonds may make them attractive. Finally, a portfolio of laddered CDs with differing maturity dates could ensure a steady liquid income stream of protected (up to $250,000) assets. See "Certificates of Deposit" in the Investing section of this Website.

Dividend Income

One often overlooked source of regular retirement income is stock dividends. Dividend producing stocks have attributes that make them ideal additions to your retirement portfolio.

One often overlooked source of regular retirement income is stock dividends. Dividend producing stocks have attributes that make them ideal additions to your retirement portfolio.

Dividends are a portion of a corporation’s profits that are paid to its shareholders. They are paid as a fixed amount per share – i.e., shareholders receive dividends in proportion to their shareholding.

When a corporation earns a profit or surplus, that money can be put to two uses: it can either be re-invested in the business (called retained earnings), or it can be distributed to shareholders. There are two ways to distribute cash to shareholders: share repurchases or dividends. Many corporations retain a portion of their earnings and pay the remainder as a dividend.

A company that has preferred stock issued must make dividend payments on those shares before money can be paid to the common stockholders. The preferred stock dividend is usually set, whereas the common stock dividend is determined at the sole discretion of the Board of Directors.

There are several things that you should know before aggressively investing in high dividend paying stocks. These subjects, addressed in this webpage, include:

- Rationale for building a dividend stock portfolio,

- How to determine what stocks to buy,

- When/how to buy, and

- Possible pitfalls

Rationale for Dividend Stocks

Before narrowing the discussion down to dividend stocks, let’s first consider the advantages of owning individual shares of a corporation (i.e., stocks):

- You are purchasing ownership interest in an actual business. The company sends you reports on its operation, lets you vote on important matters affecting it, and usually shares with you a portion of its profits.

- Knowing that you have invested in a tangible asset with real value, you can better ignore the day-to-day swings in stock market prices.

- You typically receive real monetary returns on your investment. These payouts are normally taxed at a lower rate than other income (see Qualified Dividends below). Stocks are unlike mutual fund shares that may report taxable gains to you (that you may not receive) even when they lose value.

During the first part of the twentieth century, dividends were the primary reason investors purchased stock. Today investors purchase stock to make a profit by buying low and selling high, achieve stock value appreciation, and receive dividends. However, stocks in general continue to be a reliable investment as long as you do your homework and act like “an investor instead of a speculator” (see How to Determine What to Buy in the adjacent column).

Stocks can help counter one of the most troubling financial issues in retirement – fixed Income. Inflation will continue to erode your pension and assets until you’ve lost a lot of your early retirement purchasing power. Stocks address this by providing a two-fold hedge against inflation:

- They normally increase in value over time, and

- Their dividend normally increases over time, providing you extra retirement income.

This brings up an important point: dividends are dependent on cash flow, not reported earnings. Consequently, a Board of Directors could declare and pay a dividend if cash flow was strong even though the company reported a net loss. This would be done to show continued dividend strength and prevent a possible decline in stock price caused by a change in market perception.

A vast majority of dividends are paid four times a year on a quarterly basis. This means that a stock that reports a quarterly dividend of $1.00 will pay you $0.25 each quarter. Some companies pay dividends on a monthly or annual basis. In addition to regular dividends, there are times that a company may pay a special one-time dividend.

Cash dividends, as opposed to stock or property dividends, may be mailed to you but are normally direct deposited into your bank or brokerage account. Stock dividends are pro-rata distributions of additional shares of a company’s stock to owners of the common stock. Stock dividends are issued to prompt more trading and increase liquidity, encouraging more buying and selling.

Qualified Stock Dividends

Ordinary cash dividends that meet specific criteria, as defined by the US Internal Revenue Code, are classified as qualified dividends and taxed at the lower long-term capital gains tax rate. You can assume that any dividend you receive on common or preferred stock is an ordinary dividend unless the paying corporation tells you otherwise.

The percentage tax on dividends is determined by the date on which the dividends are paid:

- From 2003 through 2007, qualified dividends were taxed at 15% or 5% depending on the individual's ordinary income tax bracket,

- From 2008 through 2012, the tax rate on qualified dividends was reduced to 0% for taxpayers in the 10% and 15% ordinary income tax brackets, and

- From 2013 through 2017, qualified dividends were taxed at 0%, 15% or 20%, depending upon income. The 0% tax continued for taxpayers in the 10% and 15% brackets. It increased to 15% on any amount that otherwise would be taxed at 25% to 39.6%, and to 20% on any amount that otherwise would be taxed at a 39.6% rate.

- From 2018 through 2025, qualified dividends are taxed at 0%, 15% or 20% based upon income and filing status (single, married, or head of household). The qualified dividend tax rates for 2024 are as follows:

| 2024 Qualified Dividend Tax Rate | Single Taxpayers | Married Couples Filing Jointly | Heads of Households |

| 0% | $0 to $47,025 | $0 to $94,050 | $0 to $63,000 |

| 15% | $47,026 - $518,900 | $94,051 - $583,750 | $63,001 to $551,350 |

| 20% | $518,901 or more | $583,751 or more | $551,351 or more |

The qualified dividend tax rates for 2025 are as follows:

| 2025 Qualified Dividend Tax Rate | Single Taxpayers | Married Couples Filing Jointly | Heads of Households |

| 0% | $0 to $48,350 | $0 to $96,700 | $0 to $64,750 |

| 15% | $48,351 - $533,400 | $96,701 - $600,050 | $64,751 to $566,700 |

| 20% | $553,401 or more | $600,051 or more | $566,701 or more |

In order to be taxed at the qualified dividend rate, the dividend must:

- Be paid by a U.S. corporation, by a corporation incorporated in a U.S. possession, by a foreign corporation located in a country that is eligible for benefits under a U.S. tax treaty that meets certain criteria, or on a foreign corporation’s stock that can be readily traded on an established U.S. stock market; and

- Meet holding period requirements: You must have held the stock for more than 60 days during the 121-day period that begins 60 days before the ex-dividend date (see definition below).

Determining Stocks to Buy

The dividend stock investor should build his/her portfolio with a diversified list of leading common stocks purchased at a reasonable price. These stocks should be chosen from a variety of industries – e.g., manufacturing, financials, information technology, utilities, media, healthcare, etc. This way you are partially insulated from poor performance within a particular industry.

According to Warren Buffet, Chairman and former CEO of Berkshire Hathaway, the following three factors should be considered in determining which stocks to buy:

- Return on Equity (ROE) – How much money is being made (returned) from the money invested in the company? An ROE above 15% for multiple years is favorable.

- Debt to Equity Ratio – How much debt does the company carry? This ratio should be below 0.5 (50%).

- Price to Earnings Ratio (P/E) – Is buying stock in this company a good deal or is it overpriced? A favorable P/E ratio is mid-teens to low 20s. P/Es of 30% to 50% are high.

According to Benjamin Graham (The Intelligent Investor), the selection of which company stocks to buy should be based on:

- Size – $100+ million of annual sales for an industrial company and $50+ millions of total assets for a public utility.

- Financial Condition – Current assets at least twice current liabilities. Long term debt should not exceed net current assets (working capital). For public utilities debt should not exceed twice the stock equity (at book value).

- Earnings – Some earnings in each of the past ten years.

- Dividend Growth – Uninterrupted payments for at least the past 20 years.

- Earnings Growth – Minimum increase of at least one-third in per-share earnings in the past ten years using three-year averages at the beginning and end.

- Price Earnings Ratio – Current price should not be more than 15 times average earnings of the past three years.

- Price to Assets Ratio – Current price should not be more than 1 ½ times the book value last reported. However, a multiplier of earnings below 15 could justify a correspondingly higher multiplier of assets. As a rule of thumb, the product of the multiplier times the ratio of price to book value should not exceed 22.5.

I realize that this is quite a list that requires a lot of analysis; however, it demonstrates the amount of homework required to make sure that you invest wisely. Just going to a website that lists stocks in order by Dividend Yield (see below) and selecting the highest yielding stocks may prove to be too risky.

Two terms that the dividend stock investor should become familiar with are Dividend Payout Ratio and Dividend Yield. Dividend Payout Ratio is the percentage of net income that is paid out in dividends. Its inverse, retained earnings ratio (amount not paid out as shareholder dividends), allows you to calculate a stock’s maximum sustainable growth rate. Just multiply it by the return on equity.

Dividend Yield, calculated by dividing the actual or indicated annual dividend by the current price per share, tells you how much you earn on a common stock from the dividend alone based on the price per share investment.

When/How to Buy

There are three important dates to consider in buying shares of dividend stock:

- Declaration Date: The day that the Board of Directors (BOD) announces their intention to pay a dividend. The BOD states the dividend amount, Date of Record and Payment Date. On this date the company creates a liability on its books for the money owed to stockholders.

- Date of Record: This date, also known as the Ex-dividend Date, is the day upon which the stockholders of record are entitled to the upcoming dividend payment. In other words, only the owners of the shares on or before the Ex-dividend date will receive the dividend. A stock will usually begin trading ex-dividend the fourth business day before the Payment Date.

- Payment Date: This is the date the dividend will actually be given to the shareholders of the company.

By understanding these dates, you should realize that it’s probably not a good idea to purchase dividend stocks just after the ex-dividend date. If you do, then someone else would be receiving the dividend for the shares that you just bought.

Building a Dividend Stock Portfolio

There are four ways to build a portfolio of dividend stocks:

- Single Purchase – After doing your analysis, decide how many shares you can afford and make your purchase.

- Multiple Purchases – After deciding how many shares of a particular dividend stock that you want to acquire, purchase them in smaller even increments over a period of time. This way, if the price goes down after your original purchase, you lower your average price per share with the second purchase. This is a form of Dollar Cost averaging where you may buy some at a higher price and others lower.

- Receive Shares via Stock Splits – Stock Splits are when a company issues two, three, four, et cetera additional shares of stock for each share that you own. (They could also do a reverse split where the number of shares that you currently own is reduced). Stock splits occur when a company feels that they have too few (and too pricey) shares of stock or too many (and too cheap) shares. In a stock split the price per share goes down causing you to end up with the same total value (i.e., share price times number of shares is equivalent).

- Receive Shares via DRIPs – a Dividend Reinvestment Plan (DRIP) is when you instruct a company to automatically reinvest your dividends in additional (and/or fractional) shares of the company’s stock instead of paying the dividends to you in cash. With DRIPs the compound growth of a single stock purchase can be substantial over many years, providing you needed income later when you begin taking your dividends in cash.

There are many benefits in enrolling in a dividend reinvestment plan:

-

- It can be done easily on a simple form.

- Once enrolled, the process is automatic.

- Many DRIPs allow you to purchase additional shares directly (direct stock purchase plan).

- Commissions are low or absent.

- Allows purchase of fractional shares.

- Dividend payments can be split, allowing some amount to be reinvested and the rest distributed.

Possible Pitfalls

Now that you’ve presumably decided that dividend stocks are right for you and a good addition to your retirement investment portfolio, let’s discuss several possible problems:

- First, there’s no guarantee that dividends will increase or for that matter continue. The company could fail or discontinue paying dividends (e.g., bank failures doing the housing crisis).

- Being overly dependent on a stock’s dividend may cause you to continue to hold the stock even when there are many signs that it’s time to sell.

All Stock Portfolio

Please see the Brokerage Account Investments Page within the Investing Section of this website for a description of my personal technique for building an all-stock portfolio. While this may subject your investments to greater risk, the benefits and return can make it attractive. Owning parts of companies instead of shares of funds can be rewarding.

Conclusion

In general, the purchase and holding of dividend stocks has many benefits and can serve as another important income in retirement. Just be sure to purchase the right stocks at the right time in the right way.