Wills & Trusts Assure that Assets are Distributed as Desired.

Trusts Defined

The purpose of a Trust is as follows:

The purpose of a Trust is as follows:

- Protect and Manage Assets,

- Minimize and/or manage taxes,

- Make gifts to children or grandchildren,

- Plan for incapacity,

- Provide anonymity and avoid publicity,

- Bypass the probate process – i.e., avoid time & expense, and

- Avoid out-of-state asset ownership issues.

There are two types of Trusts:

- Inter Vivos Trusts – Established during lifetime (e.g. Revocable Joint Trust).

- Testamentary Trusts – Created through a will and become effective only after death (e.g. Credit Shelter/Marital Trust).

Establishing a Revocable Joint (Living) Trust

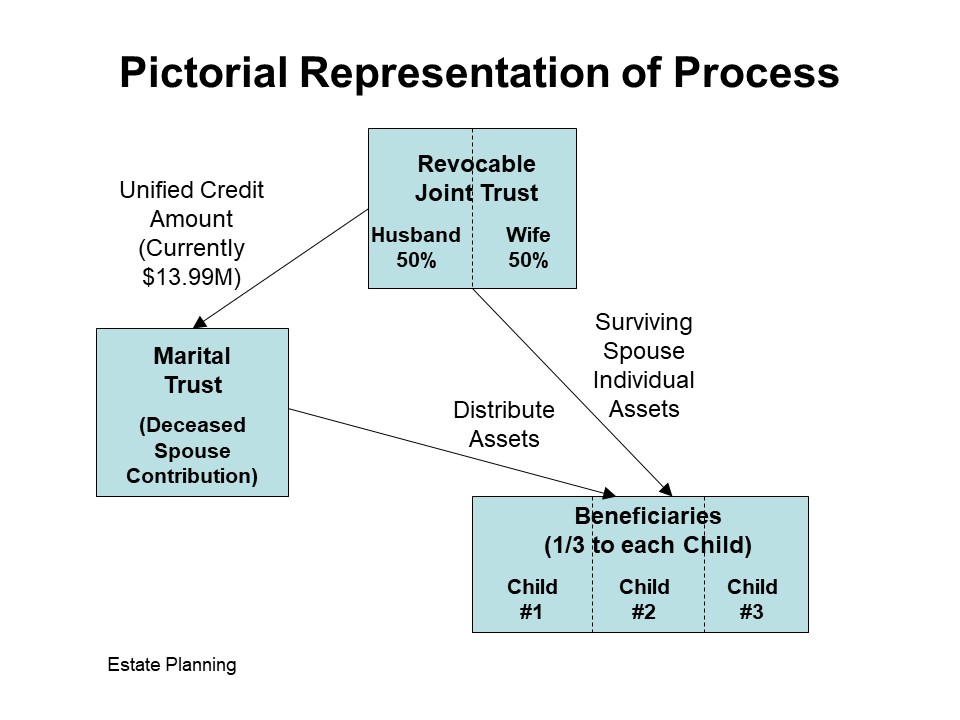

The Revocable Joint Trust is the controlling document for the Estate Plan. It can be structured as two trusts set up within one trust agreement (see diagram below) where a husband and wife are Trustees (holders) of both trusts. In the event of incapacity or death of either Trustee, the other continues to serve.

Once the trust is established, the vast majority of the couple's (the Grantors’) assets are transferred into the Trust, including:

- Joint Checking/Savings Accounts,

- Brokerage Accounts,

- Primary Residence,

- Non-Primary Residences,

- Home Equity Loans, and

- Any other Loans.

With the Trustees’ consent, additional property can be transferred during their lifetimes or at death.

Each person has one share of the Trust. All assets within the Trust, regardless of original individual ownership, are owned 50-50 by the husband and wife. During their lifetimes, the Grantors may use the assets within the Trust at their discretion.

The following diagram is an example of a Revocable Joint Trust:

|

Revocable Joint Trust Trustees: Jane Doe (50%)

John Doe (50%)

Contains Joint Assets:

Contains No Tax-Deferred Accounts |

|

|

Jane’s Trust Contains any single ownership property & accounts. |

John’s Trust Contains any single ownership property & accounts. |

Death of the First Spouse

Upon death of the first spouse (first grantor), two things happen:

- The first spouse’s assets are added to the revocable joint trust, and

- A Marital Trust (defined below) is created.

The assets added to the trust include:

- Spouse’s Life insurance proceeds (where the trust is the primary beneficiary), and

- Individually owned qualified (pre-tax) assets (where the trust is the secondary beneficiary), including IRA’s, 401(k)’s, 403(b)’s, qualified annuities, etc.

The proceeds of the deceased Grantor’s separate share may be used to pay the Grantor’s legal debts, expenses and taxes, left in the Trust, or disclaimed by the surviving spouse and added to and administered according to the terms of the Marital Trust. Upon death of the surviving spouse, their separate share of the Joint Trust, including any amounts added from the separate share of the deceased Grantor, shall be added to and administered according to the terms of the Marital Trust.

Marital Trust

The Marital Trust is a Unified Credit Shelter Trust. This irrevocable trust is created upon the death of the first Grantor. It is funded from the deceased Grantor’s share (50%) of the Joint Trust. The remaining share stays in the Joint Trust, which now becomes commonly referred to as a Family Trust.

The Marital Trust’s purpose is to remove as much money (estate tax free) from the Revocable Joint Trust as is legally allowed. This doubles the total amount of tax-free money that can be passed on to beneficiaries. With the reduction in the surviving spouse’s estate, the amount of estate taxes on funds distributed to the beneficiaries when he or she dies is reduced or eliminated.

The transfer tax system in the United States allows every person to transfer into a Credit Shelter Trust a certain amount of their estate without paying any tax on that transfer. The Credit Shelter Trust is necessary because transfers between spouses are not subject to estate tax and therefore cannot take advantage of the unified credit available to each spouse.

The maximum amount that can be transferred into a Credit Shelter (Marital) Trust is equal to the portion of the estate tax exemption ($13.99 million for 2025) that the decedent didn’t use during their lifetime. It is usually the entire exemption amount unless the decedent gave gifts in excess of the annual gift tax exclusions ($19,000 for 2025). This allowable tax-free transfer is also called the Applicable Exclusion Amount.

The Marital Trust is funded with the deceased spouses share (50%) of the Joint Trust as follows:

- If 50% of the Joint Trust’s value is greater than the applicable exclusion amount, then the Marital Trust is funded with the total exclusion amount.

- If the Joint Trust contains less than the applicable exclusion amount, the Marital Trust is funded with the deceased Grantor’s total share (after expenses).

Upon death of the surviving spouse, the assets within the Marital trust are distributed to the beneficiaries (generally to the couple’s children in equal shares). The shares of any deceased child are normally distributed equally to his/her children (i.e. the grandchildren) over 21 years old or held in trust until they reach the age of 21.

Last Will & Testament

The Last Will & Testament serves specific purposes:

- It “pours over” any assets remaining in the individual’s name at death to the Revocable Joint Trust, and

- It directs the Personal Representative (executor) to look to the Trust for funds to pay any taxes, debts and expenses, since most liquid assets will be in the Trust.

The primary Personal Representative of the estate is the spouse, and the secondary are typically the children.

There will be no estate taxes at the first death, and unless unified estate tax credits are exceeded, no tax at the survivor’s death. An article in the Will allows for the designation of someone to receive tangible personal property by a memorandum outside of the Will. In the unlikely event the provisions of the Trust are ineffective for any reason; the Will incorporates the terms of the Trust into the Will by reference.

Estate Settlement Tasks

The executor of the estate (possibly the surviving children) will work with the estate attorney, and any other professional resources they require, to perform the required administrative duties.

Following are the Estate Settlement Tasks that need to be performed upon death of one or both of the Trustees:

- Marshal Assets.

- Obtain Values (For fed/state tax returns).

- Perform Administrative Tasks (Notify, liquidate & transfer assets).

- Prepare & File Tax Returns (Estate & Income Tax for the deceased person and their trusts).

- Provide Informal/Formal Accounting (Get informal signed off, formal is required by court if questioned by beneficiary).

- Get Refunding (to cover unbudgeted expense) agreements & releases.

- Distribute Estate Assets (Hold 20% cushion initially).

Estate & Gift Tax Exemptions

The maximum lifetime credit that can be used against the federal estate tax is known as the Unified Credit. Money passing from an Estate to a beneficiary upon death of the estate owner is allowed the following lifetime credit (i.e. tax exemption). Money passing to a beneficiary as a gift while the estate owner is alive has annual exclusion limits and lifetime caps:

|

Calendar Year

|

Estate Tax Exemption

|

Highest Estate Tax Rate

|

Lifetime Gift Tax Exemption

|

Highest Gift Tax Rate

|

|

2010

|

$5,000,000 or $0*

|

35% or 0%

|

$1,000,000

|

35%

|

|

2011

|

$5,000,000

|

35%

|

$5,000,000

|

35%

|

|

2012

|

$5,120,000

|

35%

|

$5,120,000

|

35%

|

|

2013

|

$5,250,000

|

40%

|

$5,250,000

|

40%

|

|

2014

|

$5,340,000

|

40%

|

$5,340,000

|

40% |

|

2015

|

$5,430,000

|

40%

|

$5,430,000

|

40% |

|

2016

|

$5,450,000

|

40%

|

$5,450,000

|

40% |

|

2017

|

$5,490,000

|

40%

|

$5,490,000

|

40% |

|

2018

|

$11,180,000

|

40%

|

$11,180,000

|

40% |

|

2019

|

$11,400,000

|

40%

|

$11,400,000

|

40% |

|

2020

|

$11,580,000

|

40%

|

$11,580,000

|

40% |

|

2021

|

$11,700,000

|

40%

|

$11,700,000

|

40% |

|

2022

|

$12,060,000

|

40%

|

$12,060,000

|

40% |

|

2023

|

$12,920,000

|

40%

|

$12,920,000

|

40% |

|

2024

|

$13,610,000

|

40%

|

$13,610,000

|

40% |

|

2025

|

$13,990,000

|

40%

|

$13,990,000

|

40% |

*The heirs of decedents who die in 2010 had the choice to use the $5,000,000 estate exemption/35% estate tax rate or $0 estate tax exemption/0% estate tax rate coupled with use of the modified carryover basis rules.

Annual Gift Tax Exclusion

As mentioned above, you’re allowed to make annual gifts — sometimes referred to as annual exclusion gifts — that are small enough to fly under the transfer tax system radar without counting against this nontaxable portion of an estate. This annual gift tax exclusion is:

| Year | Individual | Couple |

| 2010 | $13,000 | $26,000 |

| 2011 | $13,000 | $26,000 |

| 2012 | $13,000 | $26,000 |

| 2013 | $14,000 | $28,000 |

| 2014 | $14,000 | $28,000 |

| 2015 | $14,000 | $28,000 |

| 2016 | $14,000 | $28,000 |

| 2017 | $14,000 | $28,000 |

| 2018 | $15,000 | $30,000 |

| 2019 | $15,000 | $30,000 |

| 2020 | $15,000 | $30,000 |

| 2021 | $15,000 | $30,000 |

| 2022 | $16,000 | $32,000 |

| 2023 | $17,000 | $34,000 |

| 2024 | $18,000 | $36,000 |

| 2025 | $19,000 | $38,000 |

Other Estate Planning Information

Following is some miscellaneous and summary Information:

- Probate is the presentation of a Will to the court to have the Will accepted and recorded and to have an executer appointed. A Will without titled assets, where nearly all assets are within the Joint Trust, may not have to go through probate.

- Assets pass from a deceased spouse to a surviving spouse with no estate taxes, regardless of estate size.

- Assets can pass directly to others through gifting, with no tax consequences to either the gift giver or receiver. Gifts are limited (currently) to $19,000 per person per year, with a lifetime maximum of $13.99 million.

- Personal property (furniture, jewelry, etc.) if untitled can pass directly to heirs (beneficiaries) outside the Trust.

- A Joint Trust’s tax ID is the trustees’ Social Security numbers, whereas a Marital Trust requires a new tax ID and separate tax return (Form 1041).

Conclusion

As the information above shows, everyone should work with their attorney or estate planner and have the appropriate documents to ensure proper disposition of their estate. As a minimum this includes a Last Will & Testament. If their total assets exceed $1,000,000, they should probably consider trusts (Revocable Joint Trust and Marital (Unified Credit Shelter) Trust. Through Joint and Marital Trusts, both spouses can take advantage of the Estate Tax Exemption (Unified Credit) and exempt $5.43 million each (in 2015) from federal estate tax.