Strive to maintain mental & physical health and assure quality Health Care.

Medicare Health Insurance

The good news for retirees is that Medicare, a plan managed by the Federal government, kicks in on the first of the month that you turn 65. Medicare includes basic hospital (Part A) and medical (Part B) insurance. Part A covers inpatient care in hospitals, including critical access hospitals and inpatient rehabilitation facilities. It also helps cover skilled nursing facility, hospice and home health care if you meet certain conditions. Part B helps cover medically-necessary services like doctors and other health care provider services to help maintain health and to keep certain illnesses from getting worse. Durable medical equipment (like wheelchairs, walkers, and hospital beds) and many preventative services (like screening, shots or vaccines, and yearly wellness visits) are included.

The good news for retirees is that Medicare, a plan managed by the Federal government, kicks in on the first of the month that you turn 65. Medicare includes basic hospital (Part A) and medical (Part B) insurance. Part A covers inpatient care in hospitals, including critical access hospitals and inpatient rehabilitation facilities. It also helps cover skilled nursing facility, hospice and home health care if you meet certain conditions. Part B helps cover medically-necessary services like doctors and other health care provider services to help maintain health and to keep certain illnesses from getting worse. Durable medical equipment (like wheelchairs, walkers, and hospital beds) and many preventative services (like screening, shots or vaccines, and yearly wellness visits) are included.

If you're already getting Social Security checks, enrollment into the program should be automatic. You'll get your Medicare card three months before your 65th birthday. If you're not getting Social Security payments already, you have to enroll in Medicare. The Social Security Administration (SSA) handles the enrollment process for Medicare. Call SSA at (800) 772-1213, visit the web site (www.ssa.gov), or apply at your local Social Security office. Apply three months before your 65th birthday. That way, you can be sure that your benefits will start on time.

Medicare Part A

Most people don’t pay a Part A premium because they paid Medicare taxes (for at least 40 quarters) while working. If you buy Part A, you'll pay $506.00 per month in 2023. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $506.00 per month. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $278.00 per month.

You can get premium-free Part A at 65 if:

- You already get retirement benefits from Social Security or the Railroad Retirement Board.

- You're eligible to get Social Security or Railroad benefits but haven't filed for them yet.

- You or your spouse had Medicare-covered government employment.

Medicare Part B

Although Part B is optional, you should sign up for it when you first become eligible because there is a late-enrollment penalty if you wait – i.e., the cost for Part B may go up 10% for each full 12-month period that you delay.

The amount paid for Part B (Medical insurance) coverage is based on your modified adjusted gross income (MAGI) from your income tax return. Note that the Social Security Administration uses tax returns from two years ago to determine your MAGI and correspondingly your Part B premium (e.g., the 2023 premium is based on your 2021 MAGI). As the name implies MAGI includes Adjusted Gross Income (line 11 of IRS Form 1040) plus any tax-exempt interest income (line 2a of Form 1040). Note that your Adjusted Gross Income (and MAGI) may include one-time only income such as capital gains, the sale of property, withdrawals from an IRA, or conversion from a traditional IRA to a Roth IRA.

Note that the Medicare Part B deductible for 2023 is $226. You pay this before original medicate starts to pay.

The monthly premium paid for Medicare Part B insurance for 2023 is as follows:

| If Your Yearly Income (in 2021*) was: | You Pay each month in 2023 | ||

| File Individual Tax Return | File Joint Tax Return | File Married & Separate Tax Return | |

| $97,000 or less | $194,000 or less | $97,000 or less | $164.90 |

| $97,001 - $123,000 | $194,001 - $246,000 | N/A | $230.80 |

| $123,001 - $153,000 | $246,001 - $306,000 | N/A | $329.70 |

| $153,001 - $183,000 | $306,001 - $366,000 | N/A | $428.60 |

| $183,001 - $499,999 | $366,001 - $749,999 | $97,001 - $402,999 | $527.50 |

| $500,000 & above | $750,000 & above | $403,000 & above | $560.50 |

Medicare Part C

Alternative insurance can be purchased from private insurance companies approved by Medicare. These are called Medicare Advantage Plans (Part C) and include HMOs and PPOs that follow Medicare rules and receive monthly payments from Medicare for your insurance. Advantage Plans must provide at least all Part A and Part B benefits that the original Medicare Plan provides. Each Medicare Advantage Plan can charge different out-of-pocket costs and have different rules for how you get services (like whether you need a referral to see a specialist or if you have to go to only doctors, facilities, or suppliers that belong to the plan for non‑emergency or non-urgent care). These rules can change each year.

Medicare Part D

Medicare Part D, which is administered through private companies, provides optional drug insurance to help pay for prescription drugs. There are two ways to get Medicare drug coverage (Part D):

- Medicare Drug Plans, which are available to anyone having Part A and/or Part B.

- Medicare Advantage Plans, which provide Parts A and B and sometimes Part D.

|

If Your Yearly Income (in 2021*) was: |

You Pay (In 2023) | ||

| File Individual Tax Return | File Joint Tax Return | File Married & Separate Tax Return | |

| $97,000 or less | $194,000 or less | $97,000 or less | Your Plan Premium |

| $97,001 - $123,000 | $194,001 - $246,000 | N/A | $12.20 + Your Plan Premium |

| $123,001 - $153,000 | $246,001 - $306,000 | N/A | $31.50 + Your Plan Premium |

| $153,001 - $183,000 | $306,001 - $366,000 | N/A | $50.70 + Your Plan Premium |

| $183,001 - $499,999 | $366,001 - $749,999 | $97,001 - $402,999 | $70.00 + Your Plan Premium |

| $500,000 & above | $750,000 & above | $403,000 & above | $76.40 + Your Plan Premium |

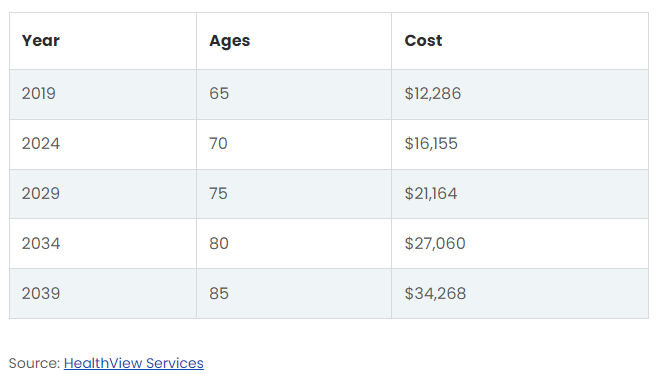

Retirement Health Care Costs

One expense that’s almost sure to increase in retirement is health care and medical, and this expense will continue to increase throughout your retirement years. Estimated annual health care costs, not including long-term care, for an average, healthy 65-year-old couple retiring in 2019 is as follows:

During retirement when this expense is higher, you could lose many mitigating benefits that you may have had while working. These include employer group insurance plans that offer medical, dental and eye care coverage at subsidized rates. In addition, you will lose any health care spending accounts that you had and start paying for health care insurance with after-tax (rather than pre-tax) dollars.

What Medicare Doesn't Cover

While Medicare provides important healthcare coverage for those 65 or older, it does not cover the following:

- Opticians & eye exams - Routine eye exams, glasses or contact lenses.

- Hearing aids - Routine hearing tests or hearing aids.

- Dental work - Routine checkups, teeth cleaning, dentures, crowns, root canals, etc.

- Overseas care - Medical costs incurred outside of the United States.

- Podiatry - Foot exams or treatment unless related to diabetic nerve damage or foot injuries/ailments.

- Cosmetic surgery - Face lifts, tummy tucks, liposuction, etc. However, plastic surgery related to an accidental injury is covered.

- Chiropractic care - Most chiropractic services or tests that a chiropractor orders, including x-rays.

- Nursing home care - Assisted living facility or nursing home. However, it does pay for limited stays in rehab facilities.

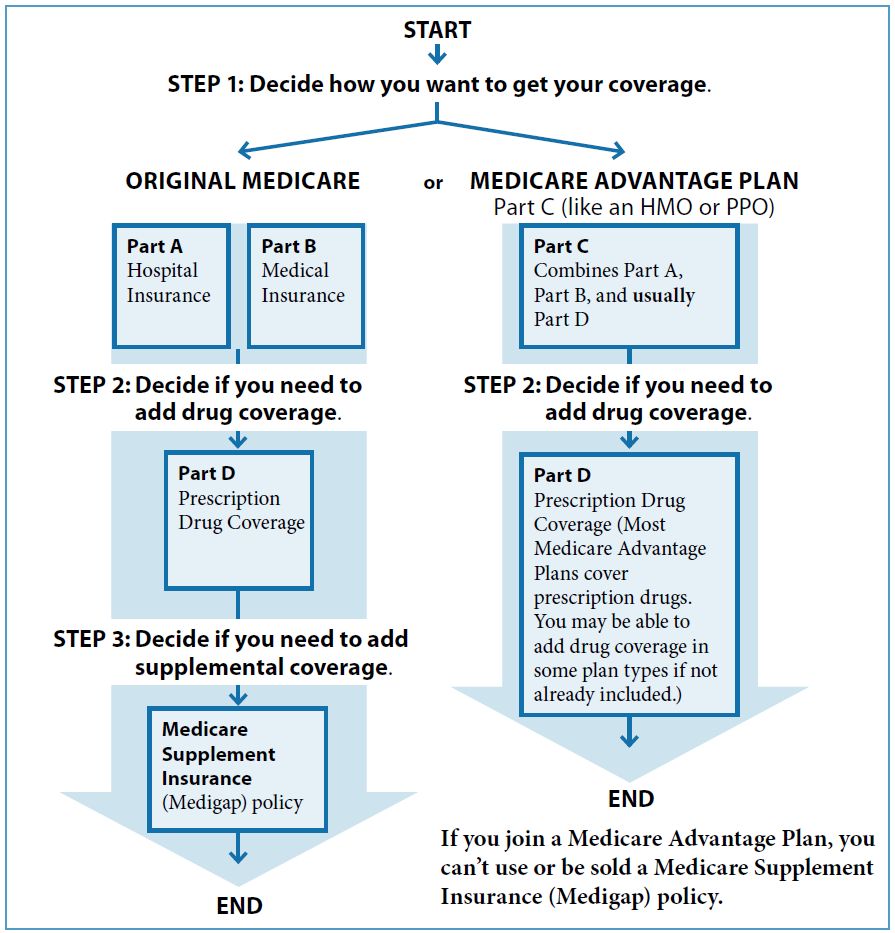

Medicare Decision Tree

To simplify the Medicare decision-making process, the "Medicare & You" Benefits Booklet provides the following chart:

Simplified Decision Process

To simply your decision-making process, I suggest that these are really only two options for retiree hospital, medical and drug coverage (note that option #2 has two additional choices):

- If your prior employer allows continuation of your health insurance benefits (hospital, medical and prescription drugs) when you retire and you are happy with the plan, then it is usually in your best interest to continue with your employer’s group plan. For retirees this could be a Medicare Supplement Insurance (Medigap) or Medicare Advantage plan. For both plans you will probably still be required to enroll in Medicare Parts A & B and possibly Part D. If your employer provides prescription drug coverage, it must be “creditable” or you will have to pay a penalty if you later choose to switch to Medicare Part D coverage. (Your employer can tell you whether its plan is “creditable”).

- If you were unemployed prior to retirement and didn’t have coverage under your spouse’s employer, then you need to do one of the following:

- Enroll in a Medicare Advantage Plan (Medicare Part C) that includes Medicare Parts A, B & usually Part D, or

- Enroll in Medicare Parts A and B, and then purchase prescription drug (Part D) coverage from a private supplier. Optionally, you may want to purchase a Medigap policy for supplemental hospital and medical coverage.

Medicare Supplement Insurance (Medigap) or secondary insurance coverage picks up where Medicare leaves off, providing additional hospital, medical, and sometimes prescription drug coverage. Note that Medigap policies that are currently being sold (i.e., after January 1, 2006) can’t include prescription drug coverage. You will need to purchase this separately.

One factor to remember is that if you and your spouse are different ages and one qualifies for Medicare and the other doesn’t, you will have different primary insurance coverage and consequently different rules (co-payments, coinsurance and deductibles) for each person.

| Please click on the following link to obtain a copy of the Annual Medicare Booklet --> | Medicare & You |

Medicare Supplement Insurance (Medigap)

Medicare pays for some, but not all, of the cost for covered health care services and supplies. Medicate Supplement Insurance (Medigap) policies sold by private companies, can help pay some of your remaining health care costs. Medigap policies require more up-front costs than Medicare Advantage Plans; however, they are more flexible. Medigap insurance is accepted by any health care professional that accepts Medicare. You do not have to be concerned by out-of-network services and can use your insurance anywhere in the country. Consequently, these plans are ideal for retirees who vacation in other parts of the country or who maintain residences in multiple states.

Medigap Plans

Medicare provides the following booklet to help you choose the right Medigap plan: Medigap Selection Guide

All health insurance companies who provide Medigap policies must provide some or all of the specific plans structured by Medicare. The table below identifies those plans and the percent of coverage that they provide. Companies cannot deviate from these plans, but they can individually determine costs for their plans.

- Every insurance company selling Medigap policies must offer Plan A. If they want to offer policies in addition to Plan A, they must also offer either Plan C or Plan F to individuals who aren't new to Medicare and either Plan D or Plan G to individuals who are new to Medicare. Not all types of Medigap policies may be available in your state.

- Plans D and G with coverage starting on or after June 1, 2010, have different benefits than Plans D or G bought before June 1, 2010.

- Plans E, H, I, and J are no longer sold, but if you already have one, you can generally keep it.

- Since January 1, 2020, Medigap plans sold to people new to Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are no longer available to people new to Medicare on or after January 1, 2020.

- – If you already have either of these two plans (or the high deductible version of Plan F) or you were covered by one of these plans before January 1, 2020, you'll be able to keep your plan. If you were eligible for Medicare before January 1, 2020, but not yet enrolled, you may be able to buy one of these plans.

- – For this situation, people new to Medicare are people who turned 65 on or after January 1, 2020, and people who get Medicare Part A (Hospital Insurance) on or after January 1, 2020.

| Medicare Supplement Insurance (Medigap) Plans | ||||||||||

| Benefits | A | B | C | D | F* | G* | K | L | M | N |

| Medicate Part A coinsurance and hospital costs (up to an additional 365 days after Medicare benefits are used). | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% |

| Medicare Part B coinsurance or copayment. | 100% | 100% | 100% | 100% | 100% | 100% | 50% | 75% | 100% | 100%*** |

| Blood (first 3 pints) | 100% | 100% | 100% | 100% | 100% | 100% | 50% | 75% | 100% | 100% |

| Part A hospice care coinsurance or copayment. | 100% | 100% | 100% | 100% | 100% | 100% | 50% | 75% | 100% | 100% |

| Skilled nursing facility care coinsurance. | 100% | 100% | 100% | 100% | 100% | 100% | 50% | 75% | 100% | 100% |

| Part A deductible. | 100% | 100% | 100% | 100% | 100% | 50% | 75% | 50% | 100% | |

| Part B deductible. | 100% | 100% | ||||||||

| Part B excess charges. | 100% | 100% | ||||||||

| Foreign travel emergency (up to plan limits) | 80% | 80% | 80% | 80% | 80% | 80% | ||||

| Out-of-pocket limit in 2023** | ||||||||||

| $6,940 | $3,470 | |||||||||

* Plans F and G also offer a high-deductible plan in some states (Plan F isn't available to people new to Medicare on or after January 1, 2020.) If you get the high-deductible option, you must pay for Medicare covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,490 in 2022 before your policy pays anything, and you must also pay a separate deductible ($250 per year) for foreign travel emergency services.

** Plans K and L show how much they'll pay for approved services before you meet your out-of-pocket yearly limit and your Part B deductible ($233 in 2022). After you meet these amounts, the plan will pay 100% of your costs for approved services for the rest of the calendar year.

*** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in an inpatient admission.