So You Think that You Can be a Landlord!

Introduction

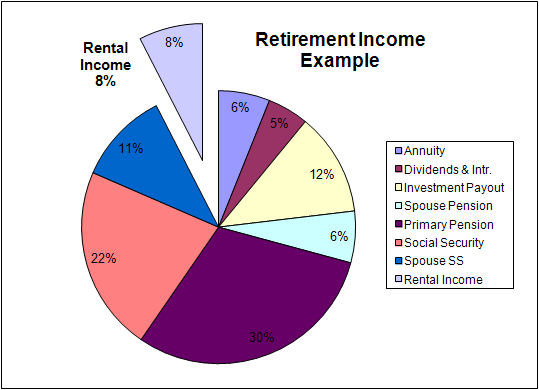

Rental property can provide a good, steady and generally predictable source of retirement income. The income can be particularly important if you don’t have monthly pension payments coming in. However, the decision to become a landlord requires considerable research and analysis. Some of the most important considerations are:

Rental property can provide a good, steady and generally predictable source of retirement income. The income can be particularly important if you don’t have monthly pension payments coming in. However, the decision to become a landlord requires considerable research and analysis. Some of the most important considerations are:

- Price, location and condition of the rental property. Is the property move-in ready or is significant renovation required before it can be rented?

- Obtaining, at a reasonable rate, capital (e.g., a mortgage) to acquire the property. What’s the up-front cost to acquire the property – e.g., down payment and closing costs?

- Likelihood of quickly obtaining and retaining tenants at the right rental price to make a profit.

- Total ongoing cost of ownership – real estate tax, insurance, management fees, etc.

- Personal time commitment to manage and maintain the property. Do you contract for this service through a rental agent?

- Rental restrictions that may impact your flexibility in renting the property.

Self-Management or Rental Agent?

Your degree of personal involvement depends upon whether you elect to manage the rental property yourself or turn it over (for a fee) to a rental agent or management company. Even with this decision, there may be questions as to the amount of services performed by the management company – for example, who is responsible for contracting for repair and maintenance work?

If you elect to save the rental agent commission, which could be as high as 20% of the rental charge, you will net greater income but significantly increase your responsibilities and tasks including:

- Advertising,

- Tenant qualification,

- Scheduling,

- Lease execution,

- Collection of rent, security deposit & taxes,

- Record keeping/retention,

- Tax reporting and payment, and

- Property repair and cleaning.

Regardless, you will need to pay real estate taxes, insurance, and possibly association fees and certain utilities. If your rentals are for periods less than six months, you may have to collect and forward additional taxes to various taxing authorities – e.g., tourist development bureau. Failure to make all of the appropriate payments to the various agencies could result in a lien placed against the property. This could result in you being prohibited from renting the property or your rental payment going to the lien holder.

Advantages & Disadvantages of Renting

There are many pros and cons for investing in rental properties and being a landlord. Some of them include:

|

Pros

|

Cons

|

|

|

One big plus of income-producing properties is that the IRS lets you depreciate the building portion of your property (minus the land) over 27.5 years, which means much of your cash flow will be tax-deferred. You'll have to recapture that depreciation when you sell, but if you never sell it and you own the property when you die, all that depreciation goes away, your heirs don't have to pay it.

Additional information regarding the depreciation of your rental property is provided later in this section.

A disadvantage is that banks typically require a larger down payment and charge higher interest rates for rental property than they do for owner-occupied homes.

Should you be forced to suddenly sell, you may find yourself in the midst of a down market (as is currently the case across most of the country) and unable to unload your home for a reasonable price, if at all.

At the same time, you may not find renters when you need them, which would force you to cover the mortgage yourself. The National Association of Realtors suggests that investors in income-producing property keep at least six months worth of reserves on hand in the event they fail to find a renter.

Tax Implications of Rental Property

IRS Publication 527 provides information on taxes associated with Residential Rental Property (Including Rental of Vacation Homes). This publication discusses rental income and expenses (including depreciation) and explains how to report them on your return. However, like most government documents and especially those associated with tax code, it is complicated and confusing. Consequently, I’ve provided the following summary of the major tax considerations regarding your rental property.

Rental Income

The following are common types of rental income:

- Regular rent payments

- Advance rent that you receive before the period that it covers

- Your tenants lease cancellation payment

- Any of your expenses paid by the tenant

- Property or services received as rent in lieu of money

- Amount of security deposit kept (if any)

Rental Property Expenses

In most cases, the expenses of renting your property, such as maintenance, insurance, taxes, and interest, can be deducted from your rental income. If you sometimes use your rental property for personal purposes, you must divide your expenses between rental and personal use. Also, your rental expense deductions may be limited. If you own a part interest in rental property, you can deduct expenses you paid according to your percentage of ownership.

Listed below are the most common rental expenses:

- Advertising for prospective tenants

- Auto and travel expenses to collect rental income or manage your property

- Cleaning and maintenance

- Real estate taxes

- Utilities (electric, gas, telephone, water, sewerage, trash collection, cable TV)

- Depreciation (see below)

- Property insurance

- Legal and other professional fees (e.g., tax preparation)

- Property management fees

- Commissions

- Mortgage interest paid to banks, etc.

- Points for prepaid interest (spread over term of loan)

- Rental payments for equipment or property

- Repairs, as differentiated from improvements (see below)

Note that work you do (or have done) on your rental property that does not add much to either the value or the life of the property, but rather keeps the property in good condition, is considered a repair, not an improvement. The cost of improvements is recovered by taking depreciation. Following are examples of improvements:

- Additions – bedroom, bathroom, deck, garage, & porch patio

- Lawn & Grounds – landscaping, driveway, walkway, fence, retaining wall, sprinkler system, swimming pool

- Miscellaneous – Storm windows, doors, new roof, central vacuum, wiring upgrades, satellite dish, security system

- Heating & Air Conditioning – a heating system, central air conditioning, furnace, duct work, central humidifier, filtration system

- Plumbing – septic system, water heater, soft water system, filtration system

- Interior Improvements – built-in appliances, kitchen modernization, flooring, wall-to-wall carpeting

- Insulation – attic, walls, floor pipes, duct work

Condominiums have special tax considerations. With a condominium you also own a share of the common elements, such as land, lobbies, elevators, and service areas. You and the other condominium owners may pay dues or assessments to a special corporation that is organized to take care of the common elements. In addition to the expenses listed above, you can deduct any dues or assessments paid for maintenance of the common elements. However, you cannot deduct special assessments for improvements, as these are recovered by taking depreciation.

If you rent buildings, rooms, or apartments, and provide basic services such as heat and light, trash collection, etc., you normally report your rental income and expenses on Schedule E, Part I. List your total income, expenses, and depreciation for each rental property. Be sure to enter the number of rental and personal use days.

Depreciation of Rental Property

Depreciation is a capital expense. It is the mechanism for recovering your cost in an income producing property and must be taken over the expected life of the property. You recover the cost of the property through yearly tax deductions. You do this by depreciating the property; that is, by deducting some of the cost each year on your tax return. Depreciation reduces your basis for figuring gain or loss on a later sale or exchange.

You begin to depreciate your rental property when you place it in service for the production of income. You can continue to claim a deduction for depreciation on property used in rental activity even if it is temporarily idle (e.g., not in use due to repairs). You stop depreciating it either when you have fully recovered your cost or other basis, or when you retire it from service, whichever happens first.

Three basic factors determine how much depreciation you can deduct:

- Your basis in the property,

- The recovery period for the property, and

- The depreciation method used.

Determining Property's Cost Basis

To figure your property's basis for depreciation, you may have to make certain adjustments (increases and decreases) for events occurring between the time you acquired the property and the time you placed it in service. The result of these adjustments to the basis is the “adjusted basis”.

You must increase the basis of the property by the cost of all capital items added. These include the following:

- The cost of any additions or improvements made before placing your property into service as a rental that have a useful life of more than one year.

- Amounts spent after a casualty to restore the damaged property.

- The cost of extending utility service lines to the property.

- Legal fees, such as the cost of defending and perfecting title, or settling zoning issues.

In addition, the following settlement fees and closing costs for buying the property must be part of the basis:

- Abstract fees,

- Charges for installing utility services,

- Legal fees,

- Recording fees,

- Surveys,

- Transfer taxes,

- Title insurance, and

- Any amounts the seller owes that you agree to pay, such as back taxes or interest, recording or mortgage fees, charges for improvements or repairs, and sales commissions.

The following are settlement fees and closing costs that you cannot include in your basis in the property:

- Fire insurance premiums,

- Rent or other charges relating to occupancy of the property before closing.

- Charges connected with getting or refinancing a loan, such as: points (discount points, loan origination fees), mortgage insurance premiums, loan assumption fees, cost of a credit report, and fees for an appraisal required by a lender.

Also, do not include amounts placed in escrow for the future payment of items such as taxes and insurance.

Depreciation Method

You must use the Modified Accelerated Cost Recovery System (MACRS) to depreciate residential rental property placed in service after 1986. MACRS consists of two systems that determine how you depreciate your property: the General Depreciation System (GDS) and the Alternative Depreciation System (ADS). You must use GDS unless you’re specifically required by law to use ADS or you elect to use ADS. The recovery period of property is the number of years over which you recover its cost or other basis.

The recovery periods are generally longer under ADS than GDS.

| GDS | ADS | |

| Residential rental property (buildings or structures) | 27.5 Yr. | 40 Yr. |

Normally you would use the GDS depreciation system. GDS provides for equal yearly deductions (except for the first and last years). ADS provides for equal yearly deductions.

A mid-month convention is used for all residential rental property. Under this convention, you treat all property placed in service, or disposed of, during any month as placed in service, or disposed of, at the midpoint of that month.

You must use the straight line method and a mid-month convention for residential rental property. In the first year that you claim depreciation for residential rental property, you can claim depreciation only for the number of months the property is in use, and you can deduct depreciation only on the part of your property used for rental purposes.

Use the following table to calculate depreciation (using GDS) for Residential Rental Property (27.5-year S/L with mid-month convention):

| Month | Year 1 | Years 2-27 |

| Jan. | 3.485% | 3.636% |

| Feb. | 3.182 | 3.636 |

| March | 2.879 | 3.636 |

| Apr. | 2.576 | 3.636 |

| May | 2.273 | 3.636 |

| June | 1.970 | 3.636 |

| July | 1.667 | 3.636 |

| Aug. | 1.364 | 3.636 |

| Sept. | 1.061 | 3.636 |

| Oct. | 0.758 | 3.636 |

| Nov. | 0.455 | 3.636 |

| Dec. | 0.152 | 3.636 |

Tax Implications of Rental Property (Cont.)

Limits on Rental Losses

One major advantage with having rental real estate activity is that you may be able to offset any loss against your total income (from all sources). However, two sets of rules may limit the amount of loss you can deduct:

- At-risk rules. These rules are applied first if there is investment in your rental real estate activity for which you are not at risk (meaning that some or all of your possible losses are covered and don’t financially impact you). This applies only if the real property was placed in service after 1986.

- Passive activity limits. In most cases, all rental real estate activities (except those meeting the exception for real estate professionals) are considered passive activities, and deductions for the losses may be limited (see below).

You generally cannot offset income, other than passive income, with losses from passive activities. Nor can you offset taxes on income, other than passive income, with credits resulting from passive activities. Any excess loss or credit is carried forward to the next tax year. The exception that allows you to offset losses against non-passive income is “material participation”.

Active (Material) Participation

Generally, you materially participated in a real estate activity for the tax year if you were involved in its operations on a regular, continuous, and substantial basis during the year. You actively participated if you (and your spouse) owned at least 10% of the rental property and you made management decisions or arranged for others to provide services (such as repairs) in a significant and bona fide sense. Management decisions that may count as active participation include approving new tenants, deciding on rental terms, approving expenditures, and other similar decisions.

If you or your spouse actively participated in a passive rental real estate activity and your modified adjusted gross income (MAGI) is $100,000 or less ($50,000 or less if married filing separately), you can deduct the following (special allowance) loss:

- $25,000 for single individuals and married individuals filing a joint return for the tax year,

- $12,500 for married individuals who file separate returns for the tax year and lived apart from their spouses at all times during the tax year, and

- $25,000 for a qualifying estate reduced by the special allowance for which the surviving spouse qualified.

If your MAGI is more than $100,000 (more than $50,000 if married filing separately), your special allowance is limited to 50% of the difference between $150,000 ($75,000 if married filing separately) and your MAGI. If your MAGI is $150,000 or more ($75,000 or more if you are married filing separately), there is no special allowance.

Personal Use of Rental Property

A day of personal use of a dwelling unit is any day that the unit is used by any of the following persons:

- You or any other person who owns an interest in it, unless you rent it to another owner as his or her main home under a shared equity financing agreement.

- A member of your family or a member of the family of any other person who owns an interest in it, unless the family member uses the dwelling unit as his or her main home and pays a fair rental price.

- Anyone under an arrangement that lets you use some other dwelling unit.

- Anyone at less than a fair rental price.

Any day that you spend working substantially full time repairing and maintaining (not improving) your property is not counted as a day of personal use.

The tax treatment of rental income and expenses for a dwelling unit that you also use for personal purposes depends on whether you use it as a home. You use a dwelling unit as a home during the tax year if you use it for personal purposes more than the greater of:

- 14 days, or

- 10% of the total days it is rented to others at a fair rental price.

If you use the dwelling unit as a home and you rent it fewer than 15 days during the year, that period is not treated as rental activity. Do not include any of the rent in your income and do not deduct any of the rental expenses.

If you use a dwelling unit for both rental and personal purposes, divide your expenses between the rental use and the personal use based on the number of days used for each purpose. When dividing your expenses, follow these rules:

- Any day that the unit is rented at a fair rental price is a day of rental use even if you used the unit for personal purposes that day.

- Any day that the unit is available for rent but not actually rented is not a day of rental use.

Following is an example of how expenses are split between personal and rental use on the Schedule E Worksheet:

| Year --> | 2024 | ||

| Total Exp. | Sch. E | ||

| Usage | |||

| Days Rented | 350 | ||

| Days Personal Use | 10 | ||

| % Rented | 97.22% | ||

| Income ($) | |||

| Rents Received | $14,400 | ||

| ------------- | |||

| Expense ($) | |||

| Insurance | 280 | 272 | |

| Cleaning & Maintenance | 4,800 | 4,667 | |

| Management Fees | 1,440 | 1,400 | |

| Mortgage Interest | 2,400 | 2,333 | |

| Supplies | 100 | 97 | |

| Repairs | 300 | 292 | |

| Real Estate Taxes | 2,100 | 2,042 | |

| Utilities | 500 | 486 | |

| ------------- | ------------- | ||

| Total (Excl. Depreciation) | 11,920 | 11,589 | |

| Cost (Property + Improvements) | 140,000 | ||

| Depreciation (26 Yr.) | 5,385 | ||

| ------------- | |||

| Total Expense | $16,974 | ||

| Income or (loss) | ($2,574) | ||

In this example the $2,574 loss could be claimed as a special deduction allowance. (Note that the allocation of expenses for taxes and interest used the “Days of Use” formula rather than the “Tax Court” formula, either of which is acceptable.) The formulas are:

- Days of Use % = #Days Rented / Total Days Used

- Tax Court % = Days Rented / Days in Year

The Tax Court method may reduce rental expenses and enable you to take additional deductions on Tax Schedule A (Itemized Deductions).

Sale or Exchange of Rental Property

You usually realize gain or loss when your rental property is sold or exchanged. A gain is the amount you realize from a sale or exchange of property that is more than its “adjusted basis”. A loss is the adjusted basis of the property that is more than the amount you realize.

The basis of property you buy is usually its cost (unless you acquired the property by gift, inheritance, or in some way other than buying it). The adjusted basis of property is your original cost or other basis plus certain additions and minus certain deductions, such as depreciation and casualty losses.

The amount you realize from a sale or exchange is the total of all money you receive plus the fair market value (defined below) of all property or services you receive. The amount you realize also includes any of your liabilities that were assumed by the buyer and any liabilities to which the property you transferred is subject, such as real estate taxes or a mortgage.

Fair market value (FMV) is the price at which the property would change hands between a buyer and a seller when both have reasonable knowledge of all the necessary facts and neither has to buy or sell. If there is a stated price for services, this price is treated as the FMV unless there is evidence to the contrary.

Rental Condominium Sale Example

You purchased a condominium for $100,000, made $20,000 of improvements, and deducted depreciation totaling $10,000. You sold the condo for $140,000 plus closing costs of $5,650. The buyer assumed your real estate taxes of $1,500 and a mortgage of $2,000 on the unit. Your gain on the sale is $37,750:

| Amount realized: | |||

| Cash | 140,000 | ||

| Assumed by Buyer: | |||

| - Real Estate Taxes | 1,500 | ||

| - Mortgage | 2,000 | ||

| Subtotal | 143,500 | ||

| Sell Closing Costs: | |||

| - Abstract fees | 250 | ||

| - Deed Stamps | 800 | ||

| - Legal Services | 400 | ||

| - Sales Commission | 4,200 | ||

| Total Realized | 5,650 | $149,150 | |

| Adjusted basis: | |||

| Cost of building | 100,000 | ||

| Improvements | 20,000 | ||

| Purchase Closing Costs | 1,400 | ||

| Total | 121,400 | ||

| Minus: Depreciation | (10,000) | ||

| Adjusted basis | $111,400 | ||

| Gain on sale | $37,750 | ||

Your gain or loss realized from a sale or exchange of property is usually a recognized gain or loss for tax purposes. Recognized gains must be included in gross income. Recognized losses are deductible from gross income. However, your gain or loss realized from certain exchanges of property is not recognized for tax purposes.