Rely on many small incomes to replace the one or two large ones.

Various Sources of Retirement Income

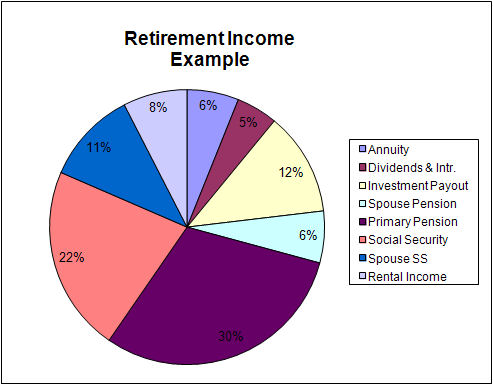

This pie chart demonstrates various possible sources of a retiree's income. Although its sections are not applicable to all retirees, it serves to demonstrate the concept of "replacing one large monthly income by many smaller incomes." Each "slice" of this pie chart is addressed in the various webpages covering the "Income" topic.

This pie chart demonstrates various possible sources of a retiree's income. Although its sections are not applicable to all retirees, it serves to demonstrate the concept of "replacing one large monthly income by many smaller incomes." Each "slice" of this pie chart is addressed in the various webpages covering the "Income" topic.

Retirement Income Overview

Pre-retirement income typically originates from one main source (your employer). You may have other income such as dividends, interest, capital gains and rental income, but these are usually dwarfed by your employment income. Retirement income is usually quite different in that it is made up of several, or oftentimes many, individual sources. For example you may receive a social Security check as well as a pension check and an annuity check. Your spouse may receive a social security check as well as others. Each source may be significantly smaller than your employer’s check, but hopefully together the group of individual checks constitutes a significant portion (50-80%) of your pre-retirement income.

Another interesting phenomenon with retirement income is that while you are working your employer sets your salary; however, once you retire, you decide how much salary that you’re going to receive. You will need to withdraw each month at least enough to meet your budget requirements. Money can be withdrawn from a tax-deferred account without penalty once you reach the age of 59 ½, and a portion of it must be withdrawn annually once you reach the age of 73. The amount that you withdraw will determine how long your savings will last and the amount of income taxes that you pay during the current year.

Where possible you should time your withdrawals so as to minimize your taxes. For example, if you receive any extraordinary income in a given year (e.g., deferred salary, stock exercise income, a large capital gain), then you should try to minimize your other income (e.g., withdrawals) during that year. If you can avoid it, you don’t want a spike in income that could bump you into a higher tax bracket. As a simple rule “prior to retirement focus on income and after retirement focus on taxes”.

There are fundamentally seven, and only seven, sources of retirement income – pension, social security, dividends, interest, annuity payments, investment fund payouts/withdrawals, and rent and royalty income. The following web pages provide a description of each and suggest way of using them together to rightsize your income.

In the adjacent column of this page is an example of how the various forms of retirement income can work together to provide you with the lifestyle you desire. Notice that I didn't say "what you deserve" because I believe that we only deserve what we plan for and build. This section should assist you in building an investment and income portfolio that will help ensure "the best retirement of a lifetime".

Keep in mind that the pie chart example is based on hypothetical data. Your pie chart will probably differ substantially based on where you put your investment dollars in per-retirement years.